Life Insurance

Baldwin County Schools offers voluntary life and accidental death and dismemberment (AD&D) insurance at affordable group insurance rates through Voya Financial. You may elect life insurance, AD&D insurance, or both. The AD&D benefit pays in the event of death or loss of limbs, speech, hearing, and more caused by a covered accident.

The new employee Guarantee Issue amounts are as follows:

- Employee: Up to the lesser of $300,000 or 3x earnings

- Spouse: Up to $50,000

Should you elect an amount that exceeds the Guarantee Issue, an Evidence of Insurability (EOI) form will be required for underwriting review. You will not be deducted for an amount that exceeds the Guarantee Issue unless you are approved.

|

Life Insurance and AD&D Options (separate elections) |

|

|---|---|

|

Employee

|

1 to 5 times your annual pay to a maximum of $500,000 Existing benefit elections that exceed the 2026 maximums will continue to 2026. |

|

Spouse

|

$10,000 increments to a maximum of $250,000, not to exceed 100% of the employee’s amount Employees currently enrolled with a $5,000 increment will be enrolled in the next higher $10,000 increment for 2026. |

|

Child(ren)

|

$10,000 or $20,000 Employees currently enrolled with $5,000 will be enrolled with $10,000 in coverage for 2026. |

Important Notes

- Benefits do not reduce due to age.

- Spouse life cannot exceed 100% of employee amount

- Spouse rates are based on the age of the employee

- Child(ren) can be covered until age 26

- Voluntary Life and Accidental Death & Dismemberment (AD&D) are seperate elections. AD&D is paid according to a schedule outlined in the certificate.

- You will be enrolled in the new Voya Financial life insurance plan based on your current elections unless you make updates during Open Enrollment.

- Health questions do not apply for AD&D elections or for child life insurance elections.

About Your Beneficiary

During your enrollment, you will be required to review your life insurance beneficiary. The beneficiary is the person you designate to receive your life insurance benefits upon your passing. Your beneficiary can be a person or multiple people, charitable institutions, or your estate. Once named, your beneficiary remains on file until you make a change.

Portability and Conversion

Coverage continuation options are available in the event of employment separation. If you wish to continue your coverage upon separation, you must contact Voya Financial within 30 days of separation. Portability coverage must be elected prior to age 70 and portability coverage terminates at age 80. The portability rates are different from the active employee rates.

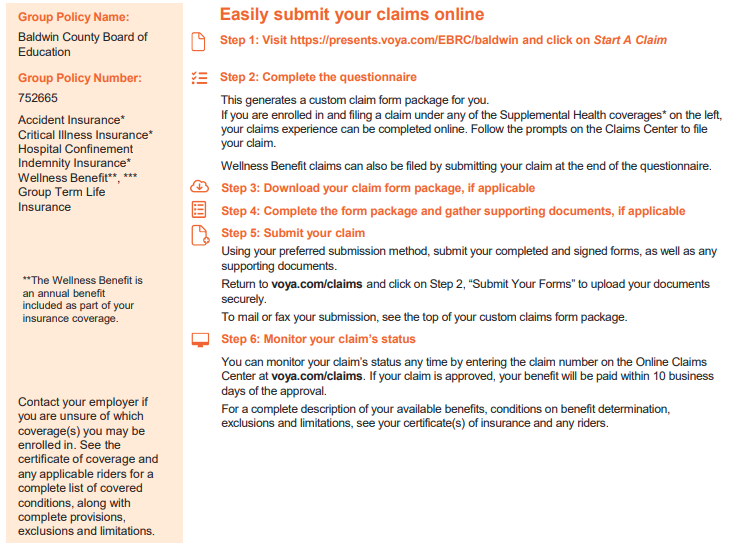

How to File a Life Insurance Claim