Critical Illness

Baldwin County Schools is excited to offer a new Critical Illness plan through Voya Financial that provides a monetary benefit to help with the out-of-pocket medical and non-medical expenses upon diagnosis of a covered illness. Critical Illness insurance helps you and your family maintain financial security during the recovery period of a serious medical event, such as cancer, heart attack, or stroke. This plan pays a benefit if the initial diagnosis for a covered illness is while the certificate is in force. An infectious disease requires a minimum of 5 consecutive days confined in a hospital to be considered for reimbursement. Please refer to the Certificate for details.

Coverage amount for employees and spouses are available as follows:

Employees: $10,000, $20,000, $30,000, or $40,000

Spouses: 50% of the employee amount

- Employees must be enrolled to elect spouse coverage.

Children: 50% of employee coverage for all children (included in employee rate)

- Employees must be enrolled to elect child coverage

Employees may elect up to the maximum amount of coverage for yourself and your spouse with no health questions. Additional information on the plan is below.

Features

- Benefits are paid in addition to any other insurance that you may have, and benefits are paid directly to you

- This plan pays a benefit if the initial diagnosis for a covered illness is while the certificate is in force. (See certificate for complete details.)

- This product may pay multiple times for the same or different covered conditions (see the certificate on the Resources page for additional information)

- Benefits may be used however you'd like. Typical uses include:

- Out-of-pocket medical and non-medical expenses

- Home health care needs and home modifications

- Recovery and rehabilitation

- Child care or caregiver expenses

- Travel expenses to and from treatment centers

Wellness Benefit Included

The voluntary Critical Illness plan includes a wellness benefit for covered preventive screenings, including but not limited to:

- Chest X-Ray

- Mammogram

- Hemoccult

- Colonoscopy

- CA 125 and CEA blood tests

- Prostate specific antigen testing

- Women's wellness

Wellness Benefit Amount

- Employee: $50

- Spouse: $50

- Child(ren): $50

Maximum benefit of once/year/insured

| Covered Diagnoses |

|---|

| Heart Attack |

|

Cancer Invasive: 100% plus additional 25% | Non-invasive/in situ: 50% | Skin cancer: 10% - 1/year; 10/lifetime | Bone marrow and stem cell transplants |

| Stroke |

| Sudden cardiac arrest |

| Major organ transplant incl. failure and ESRD |

| Coronary artery bypass: 75% |

| Type 1 diabetes |

| Severe burns |

| Open heart surgery to replace or repair valve: 25% |

| Benign brain tumor |

| Permanent paralysis |

| Loss of sight, hearing, or speech |

| Coma |

| Multiple sclerosis |

| Amyotrophic lateral sclerosis (ALS) |

| Parkinson’s disease |

| Advanced dementia, including Alzheimer’s disease |

| Huntington’s disease |

| Muscular dystrophy |

| Infectious disease: 25% |

| Myasthenia gravis: 50% |

| Systemic lupus erythematosus: 50% |

|

Additional child conditions - Cerebral Palsy - Congenital birth defects - Cystic Fibrosis - Down syndrome - Sickle Cell Anemia - Zellweger Syndrome - And more |

| *The above conditions are covered at 100% unless noted. Additional conditions are covered at a lesser benefit amount. Please refer to the Benefit Summary for details. |

| Heart attack, stroke, and sudden cardiac arrest include an additional 10% benefit. |

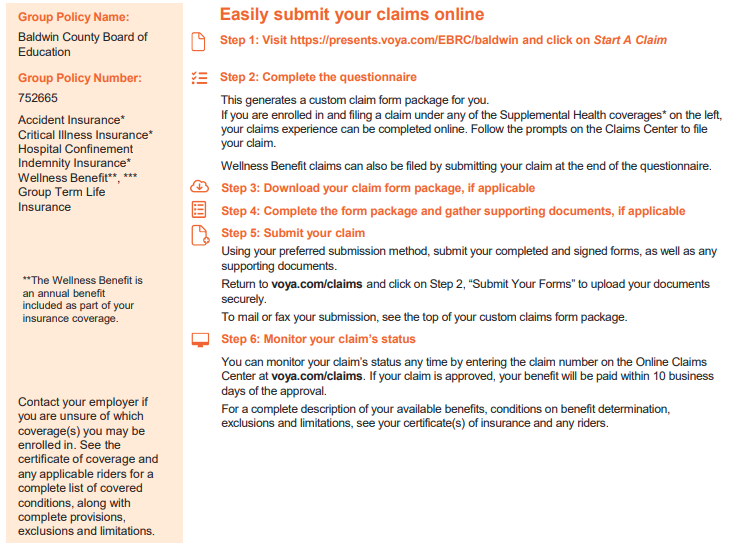

How to File a Claim